22.5% decline in India HCP market

May 18, 2020

The India HCP market observed its sharpest year-over-year decline of 22.5% in the first quarter of 2020, following supply chain disruption, IDC India reports.

The India HCP market observed its sharpest year-over-year decline of 22.5% in the first quarter of 2020, following supply chain disruption, IDC India reports.

The India HCP market registered shipments of 0.66 million units in calendar year 1Q20, with a decline of 22.5% year-over-year (YoY), according to the latest IDC Worldwide Quarterly Hardcopy Peripherals Tracker, 1Q20. Following the disruption in supply chain and demand shock due to COVID-19, the HCP industry observed the sharpest quarter-over-quarter (QoQ) decline of 16.5%, to date.

Supply was disrupted since most of the vendors have their manufacturing in China. As a result, the shipments to India were heavily impacted in February and beginning of March. This was further accentuated by the countrywide lockdown from 24 March, leading to further disruptions in the market from both supply and demand perspectives.

This resulted in a sharp YoY decline in the Inkjet and Laser segment (including the copier segment) by 22.4% and 22.6%, respectively. Moreover, many orders, which were supposed to be executed in the 2nd half of March, could not be delivered to the channel leading to reverse invoicing in a few cases.

“Laser copier segment witnessed maximum impact, declining by 48.7% YoY. Also, to sever supply challenges, many orders remain unbilled since most of the orders in this segment are typically executed in the second half of March. Furthermore, Q1 typically sees strong demand from the government, which was impacted majorly, leading to multiple orders being either put on hold or cancelled. While the overall inkjet market declined, the Ink tank segment gained market share by 4.5% YoY. SOHOs and consumer segment particularly continue to swiftly adopt ink tank over ink cartridge-based models,” said Bani Johri, Market Analyst, IPDS, IDC India.

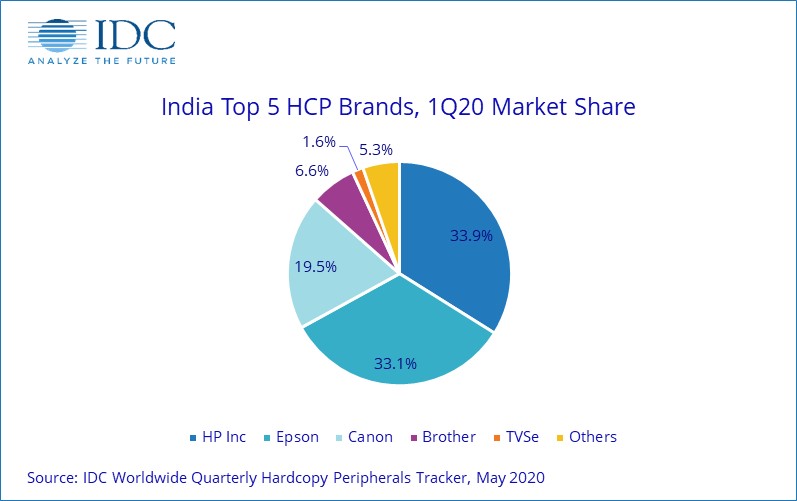

HP Inc. (excluding Samsung) maintained its leadership in HCP with a market share of 33.9% while its shipment declined by 30.0% YoY. It faced severe supply issues as its manufacturing units are based in China. While the Laser Printer segment declined by 20.5% YoY, the inkjet segment declined by 46.5% YoY. HP dropped to the third position in the Inkjet segment, primarily because of its supply issues. On the Laser printer front, HP continued to maintain its number one position with a 61.0% market share.

Epson maintained its second position in the overall HCP market with a market share of 33.1%. Like other vendors, Epson was also forced to close its books early in March which lead to a decline in shipments by 17.8% YoY. Apart from a couple of models, Epson did not face severe supply issues, IDC said. It also strengthened its leadership position in the inkjet segment by registering its highest unit market share of 60.4%, to date.

Canon recorded a YoY decline of 5.8% while maintaining its third position in the HCP market and capturing a 19.5% market share. In the inkjet segment, while Canon declined YoY by 8.5% as a result of supply issues, it played a key role in increasing the market share of the overall ink tank segment, IDC explained. In the Laser Copier segment, although Canon declined by 37.2% YoY, yet it continues to lead the copier market with 29.3% market share as a result of its wide product portfolio and a strong foothold in the corporate segment.

“Due to COVID-19 pandemic resulting in multiple tranches of nationwide lockdown, there is a lot of uncertainty resulting in frequent changes to the outlook for the coming quarters. However, under the assumption that things become normal from 3Q20 onwards, vendors are still likely to face a slowdown in consumer demand as they prioritize their spending towards essential goods.

“However, despite weakness in consumer demand, IDC expects the India HCP market to start showing signs of recovery from 3Q20 onwards as economic growth starts rebounding. Vendors are likely to go aggressive with their marketing and promotional campaigns during 4Q20 to cash in on the festive season. IDC also expects brands to make a significant push towards online sales as the fears around COVID-19 are likely to play on consumer’s minds while considering a visit to retail stores. Commercial printing demand is also likely to witness a slowdown in the aftermath of lockdown as organizations might look to continue with remote working post lockdown as well,” said Nishant Bansal, Senior Research Manager, IPDS, IDC India.

Categories : Around the Industry

Tags : HCP Market IDC India Market Research