Industrial printer market in A/NZ drops 33.8%

July 6, 2020

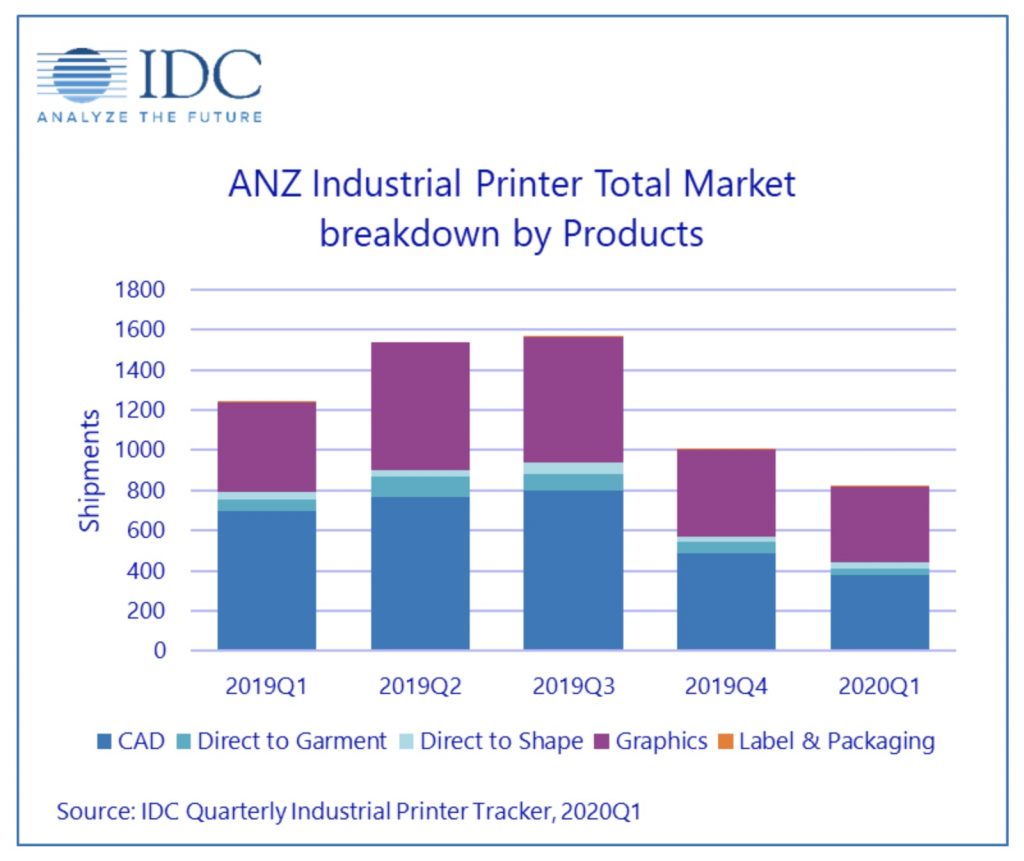

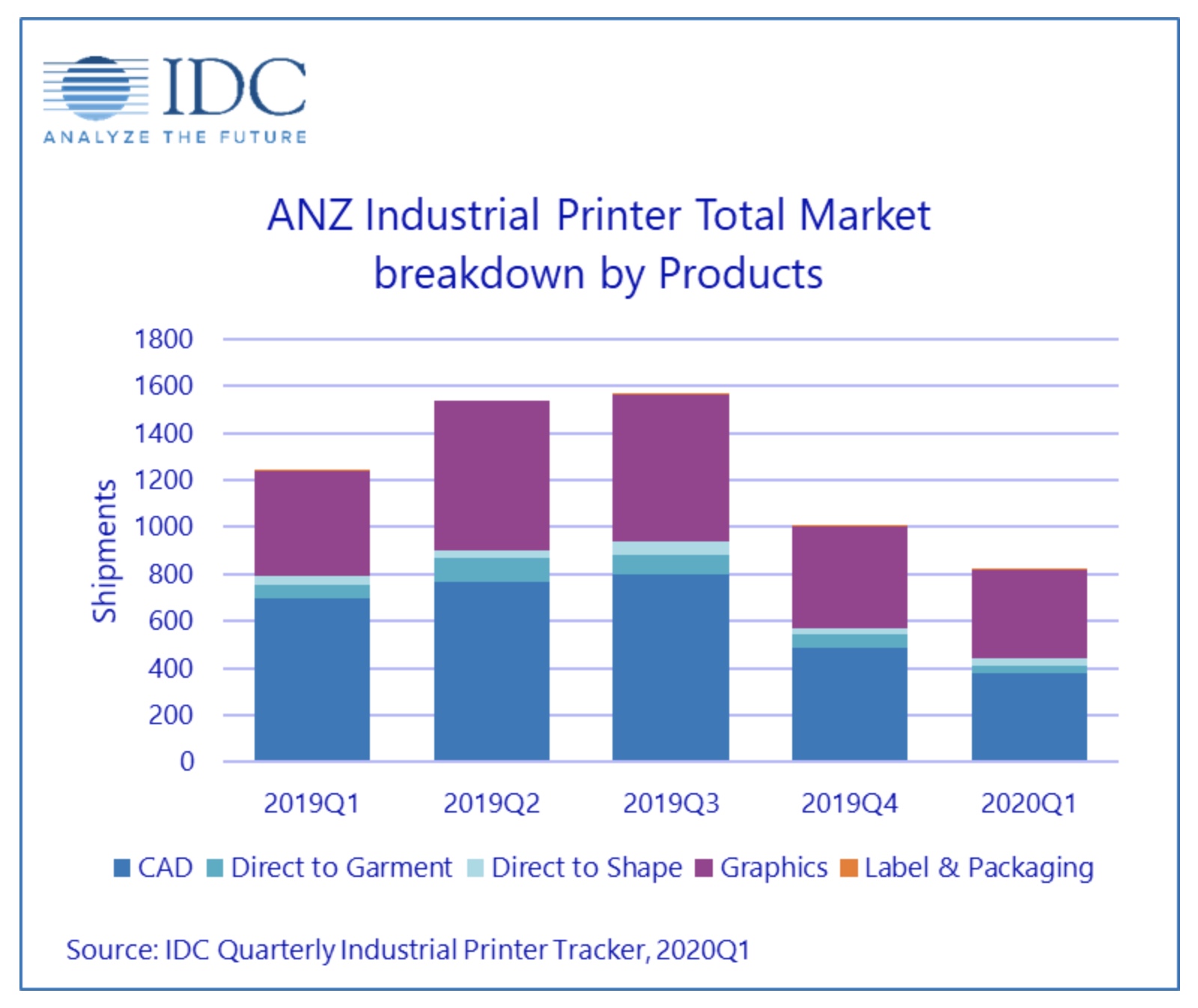

According to the IDC Worldwide Quarterly Industrial Printer Tracker, the industrial printer market in Australia and New Zealand declined significantly in the first quarter 2020 period, with a quarter-on-quarter (QoQ) decline of 18.39% and year-on-year (YoY) decline of 33.79%.

According to the IDC Worldwide Quarterly Industrial Printer Tracker, the industrial printer market in Australia and New Zealand declined significantly in the first quarter 2020 period, with a quarter-on-quarter (QoQ) decline of 18.39% and year-on-year (YoY) decline of 33.79%.

Printing and advertising businesses across Australia and New Zealand are seeing a drastic reduction in business due to significant declines in the hospitality, tourism, and entertainment industries. Shrinking demand for Static Out-Of-Home (OOH) advertising, in particular billboards, has led to a reduction in shipments of large format graphic printers (sizing 1.8 metres and above).

“Bush fires in the December/January period, trade conflict between the US and China, and the COVID-19 pandemic have all contributed to the contraction in the market,” said Muhammad Faris Latief, Market Analyst for Imaging, Printing and Document Solutions (IPDS) at IDC Asia/Pacific.

“Advertising businesses are increasing their use of digital ad-sense and digital signage, instead of installing new signage or billboards, as a result of declines in foot traffic,” Latief added.

According to this latest data, print service providers offering photo printing and sublimation printing are also showing sluggish activity as a result of COVID-19, resulting in a decline in graphic printer installation in the first quarter of 2020. Overall graphic printers declined 13% QoQ and 15% YoY.

Similarly, the technical printer market or computer-aided design (CAD) large format printer market, is also showing a significant decline with more than 20% QoQ decline and 45% YoY decline. This has been driven by the halt of construction activity in March as a result of Government-imposed measures to combat the pandemic. April saw a resumption of construction, but this was limited to public and vital infrastructure projects. “In May and June, we have seen further lifting of restrictions, and expect construction activity to return to near-normal in July,” said Latief.

“Ultimately, we expect a rebound in shipments for the Industrial Printer market in 2020Q2 with the recovery in business sentiment as a result of the gradual resumption of regular business activity,” Latief added.

Categories : Around the Industry

Tags : IDC Industrial Print Market Data