HP-Xerox: The wooing continue

December 10, 2019

Xerox’s Chief Executive Officer John Visentin, has made a 33 page presentation to HP shareholders, saying the takeover would potentially create as much as $1.5 billion (€1.35 billion) in revenue growth.

The presentation was released by the shareholders, showing how John Visentin outlined the case of the potential deal between Xerox and HP. He argued that after the tie-up, the companies combined would be worth $31 (€27.99) a share to HP investors and showed that the merger would generate more than $4 billion (€3.61 billion) in free cash flow

Xerox previously state that the deal would generate $2 billion (€1.8 billion) in synergies which in the presentation Visentin argues they will achieve within the first 24 months by streamlining operations, cost reduction, supplier sharing and reducing the companies’ property footprints, and other measures.

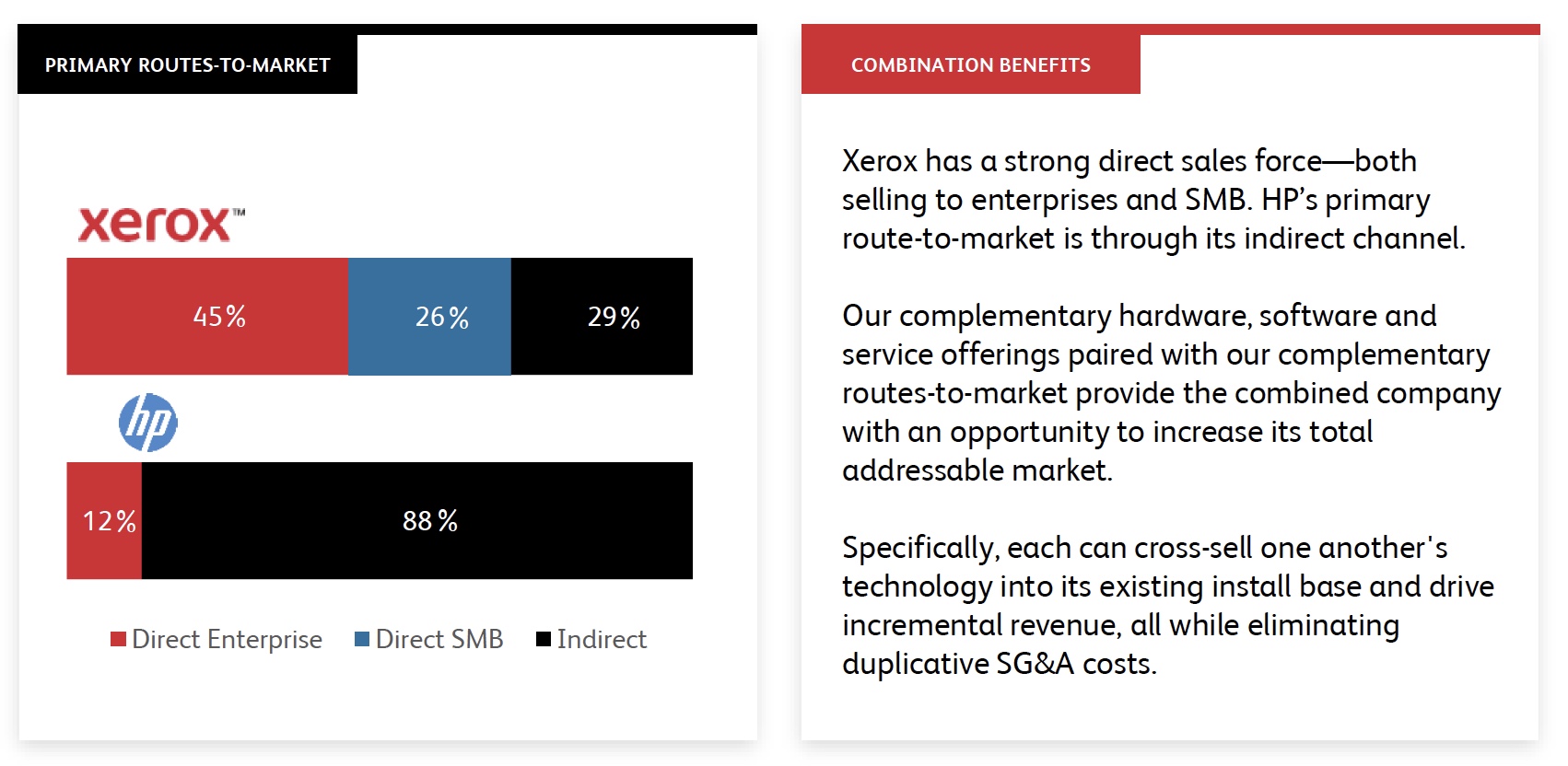

In the presentation Visentin makes the case for cross selling and a unified platform for customers which he estimates could generate $1 billion to $1.5 billion (€0.9 billion to €1.35 billion) in revenue growth within three years.

HP’s board unanimously rejected Xerox’s offer last month stating: “We believe it is important to emphasise that we are not dependent on a Xerox combination. We have great confidence in our strategy and the numerous opportunities available to HP to drive sustainable long-term value, including the deployment of our strong balance sheet for increased share repurchases of our significantly undervalued stock and for value-creating M&A.”

Earlier this month, in an open letter to HP shareholders, Carl Icahn, shareholder in HP and Xerox, asked his fellow shareholders to reach out to the directors and called the HP-Xerox merger a most obvious “no-brainer” deal.

Editor’s Opinion: The Xerox proposal is gaining traction and looks a better deal than the two icons remaining separate.

Categories : Around the Industry

Tags : Acquisition HP Merger Xerox