Hardcopy shipments dipped below 17 million

February 13, 2023

Western European shipments of hardcopy peripherals declined 4.1% year-over-year to 16.7 million units in 2022, says IDC.

Western European shipments of hardcopy peripherals declined 4.1% year-over-year to 16.7 million units in 2022, says IDC.

Supply chain issues continue to hamper opportunities for most brands, especially in the consumer segment, but it was not all doom and gloom, as some saw their shipments and revenues increase as they had adequate inventory to meet consumer and business demand, according to IDC’s Worldwide Quarterly Hardcopy Peripherals Tracker.

Overall shipments for 4Q22 increased 13.2% year on year, but this was not enough to record an annual increase as weak shipments in the first three quarters of the year meant that overall shipments declined. There were, however, some pockets of success with overall laser shipments increasing in 4Q22 and for 2022; the inkjet market showed an increase in 4Q22, but poor shipments in earlier quarters meant the market contracted for the year.

Highlights from the quarter and the year include:

- Inkjet shipments increased by 13.2% in 4Q22 year on year, meaning that the overall 2022 market contracted by 4.1% year on year.

- Inkjet shipments increased by 14.3% in 4Q22, but weak shipments earlier in the year meant that 2022 saw an overall decline of 5.7%. Consumer and business inkjets increased during the quarter but declined for the whole of 2022.

- Laser shipments increased by 14.3% in 4Q22 as some brands had better inventory, and this led to overall 2022 shipments recording growth of 0.2%.

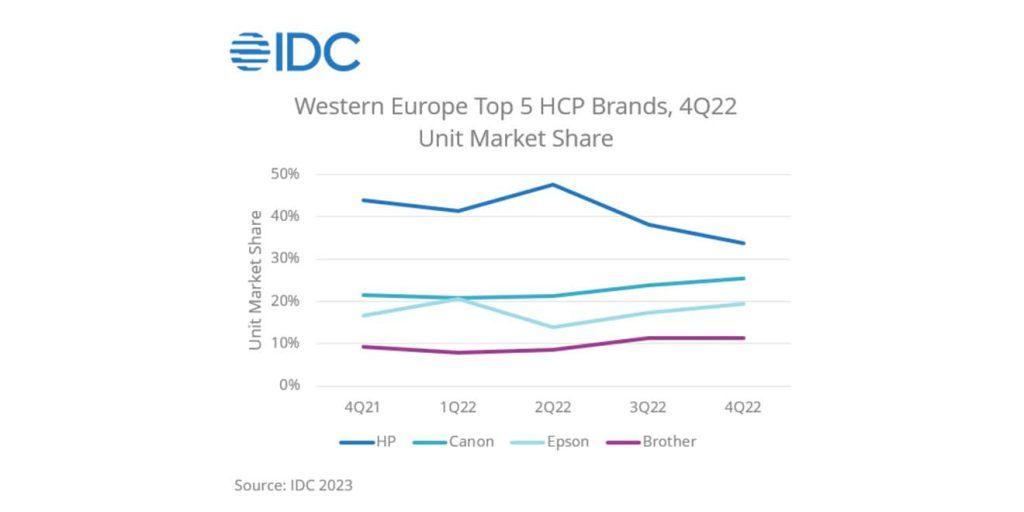

- HP retains the overall market leadership with 33.6%. Canon and Epson both saw their shares increase, but Brother ‘s share remained flat. All compete in the high-volume markets.

The above chart shows the top four brands by unit shipments for the past five quarters.

“Although the overall market contracted in 2022, the end of the year saw some recovery as some of the leading brands received better inventory and saw their shipments and share increase. Although the supply chain issues are showing some signs of improvement, they will still impact the market going into 2023,” said Phil Sargeant, Senior Programme Director, Western European Imaging, Hardware Devices, and Document Solutions group, IDC.

Main country highlights:

Germany: Overall shipments increased 31.0% in 4Q22 with both inkjet and laser segments showing year-on-year increases. This strong quarter led to the overall German market increasing by 0.9% for 2022, with the inkjet segment recording an increase and laser showing a small decline.

France: The French market increased by 25.4% in 4Q22. Both inkjet and laser segments recorded double-digit growth for a strong end to the year. But despite these quarterly increases, the overall 2022 market declined. In contrast to Germany, however, the inkjet segment declined and the laser segment increased.

The UK: Overall shipments reversed the trend as shipments declined in 4Q22 by 5.9% as both inkjet and laser segments weakened. The U.K. was one of the poorer performing countries, with 2022 figures showing a double-digit decline. As a result both inkjet and laser segments shrunk.

Italy: Strong inkjet and laser shipments saw the Italian market increase by 22.5% for the quarter, but this wasn’t enough for 2022 to show an increase despite the overall laser segment increasing for the year.

Spain: Inkjet and laser shipments increased in 4Q22, but weaker shipments in the first three quarters of the year meant that overall 2022 shipments declined with inkjet and laser shipments contracting for the year.

Categories : World Focus

Tags : HCP Shipments IDC Inkjet Laser Market Insights Research