PC shipments begin to slow

April 11, 2022

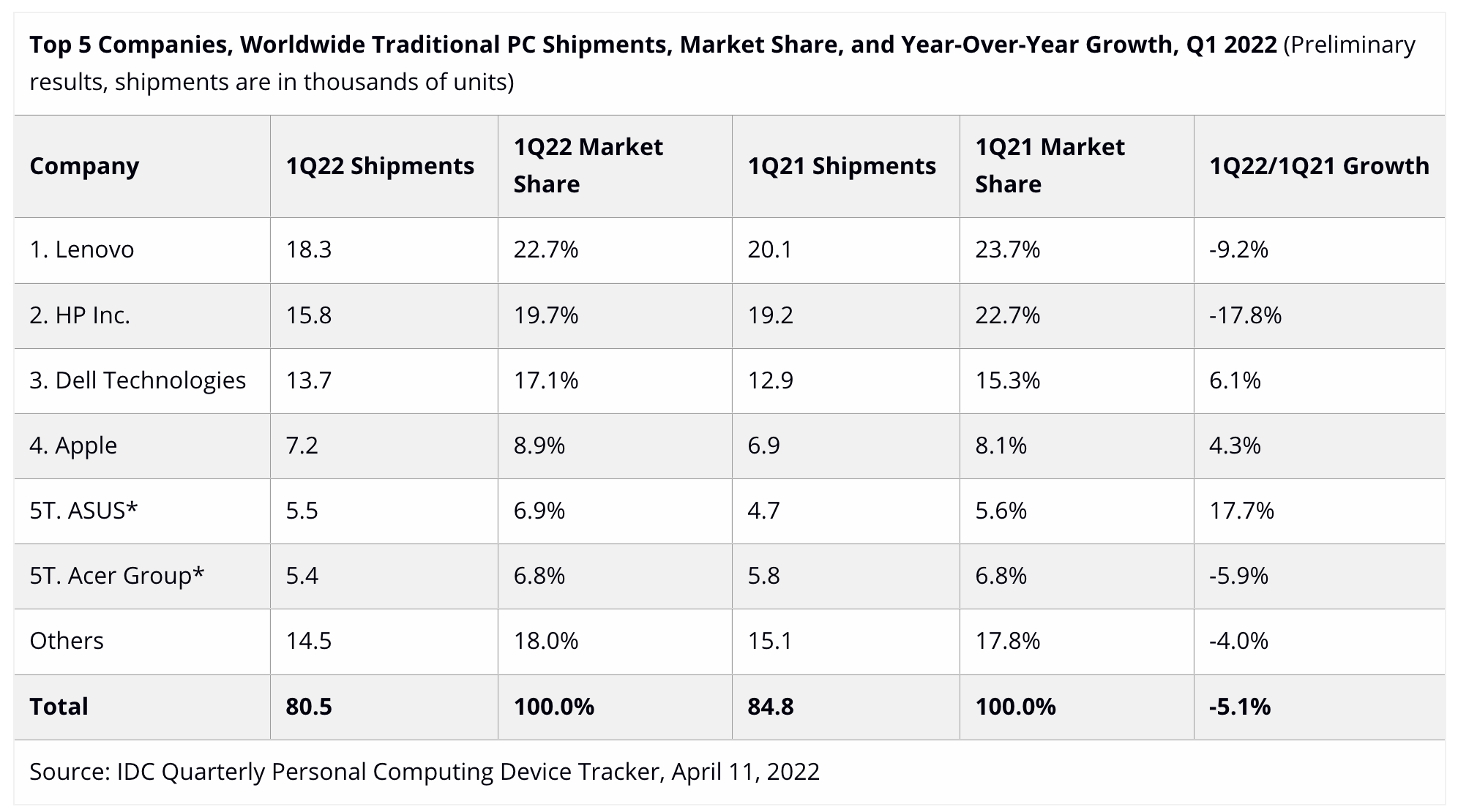

Global shipments of traditional PCs, including desktops, notebooks, and workstations, declined 5.1% in the first quarter of 2022 (1Q22) but exceeded earlier forecasts, according to preliminary results from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

The PC market is coming off two years of double-digit growth, so while the first quarter decline is a change in this momentum, IDC said it does not mean the industry is in a downward spiral. Despite ongoing supply chain and logistical challenges, vendors still shipped 80.5 million PCs during the quarter. The 1Q22 volume marks the seventh consecutive quarter where global shipments surpassed 80 million, a feat not seen since 2012, IDC added.

“The focus shouldn’t be on the year-over-year decline in PC volumes because that was to be expected. The focus should be on the PC industry managing to ship more than 80 million PCs at a time when logistics and supply chain are still a mess, accompanied by numerous geopolitical and pandemic-related challenges,” said Ryan Reith, Group Vice President with IDC’s Worldwide Mobile Device Trackers. “We have witnessed some slowdown in both the education and consumer markets, but all indicators show demand for commercial PCs remains very strong. We also believe that the consumer market will pick up again in the near future. The result of 1Q22 was PC shipment volumes that were near record levels for a first quarter.”

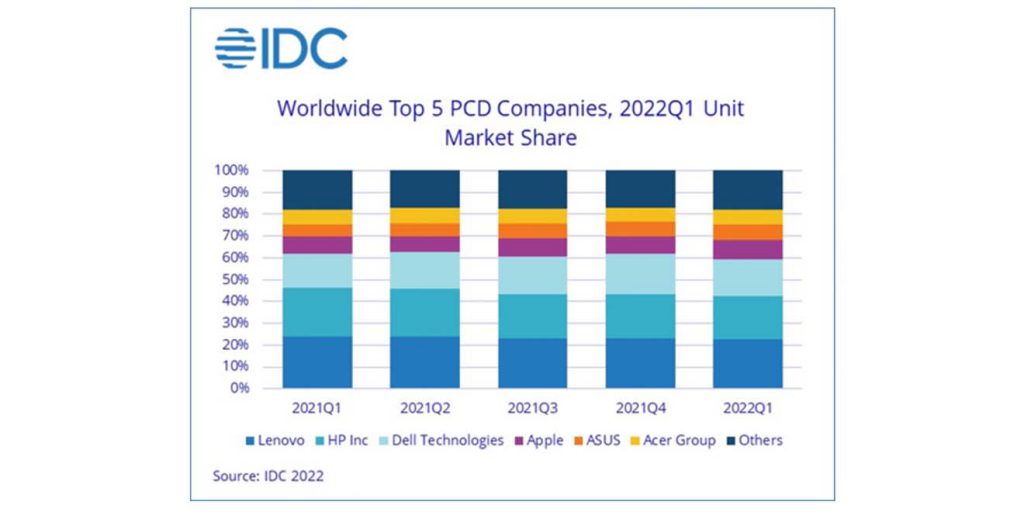

The rankings among the top vendors remained unchanged in 1Q22 compared to the fourth quarter of 2021. Lenovo remained the top company with 22.7% market share, followed by HP Inc., Dell Technologies, and Apple. ASUS and Acer tied for the number five position in 1Q22. Dell, Apple, and ASUS were the only top-tier vendors that saw year-over-year shipment growth. As a result of the on-going supply chain shortages and a challenging comparison to a strong 1Q21, notebook PCs saw a year-over-year decline while desktops grew slightly.

The rankings among the top vendors remained unchanged in 1Q22 compared to the fourth quarter of 2021. Lenovo remained the top company with 22.7% market share, followed by HP Inc., Dell Technologies, and Apple. ASUS and Acer tied for the number five position in 1Q22. Dell, Apple, and ASUS were the only top-tier vendors that saw year-over-year shipment growth. As a result of the on-going supply chain shortages and a challenging comparison to a strong 1Q21, notebook PCs saw a year-over-year decline while desktops grew slightly.

“Even as parts of the market slow due to demand saturation and rising costs, we still see some silver linings in a market that has reached an inflection point towards a slower pace of growth,” said Jay Chou, Research Manager for IDC’s Quarterly PC Monitor Tracker. “Aside from commercial spending on PCs, there are still emerging markets where demand had been neglected in the earlier periods of the pandemic, and higher end consumer demand also has held up.”

Categories : Around the Industry

Tags : IDC Market Research PC Shipments Tracker