HCP market surges in APeJ

June 9, 2023

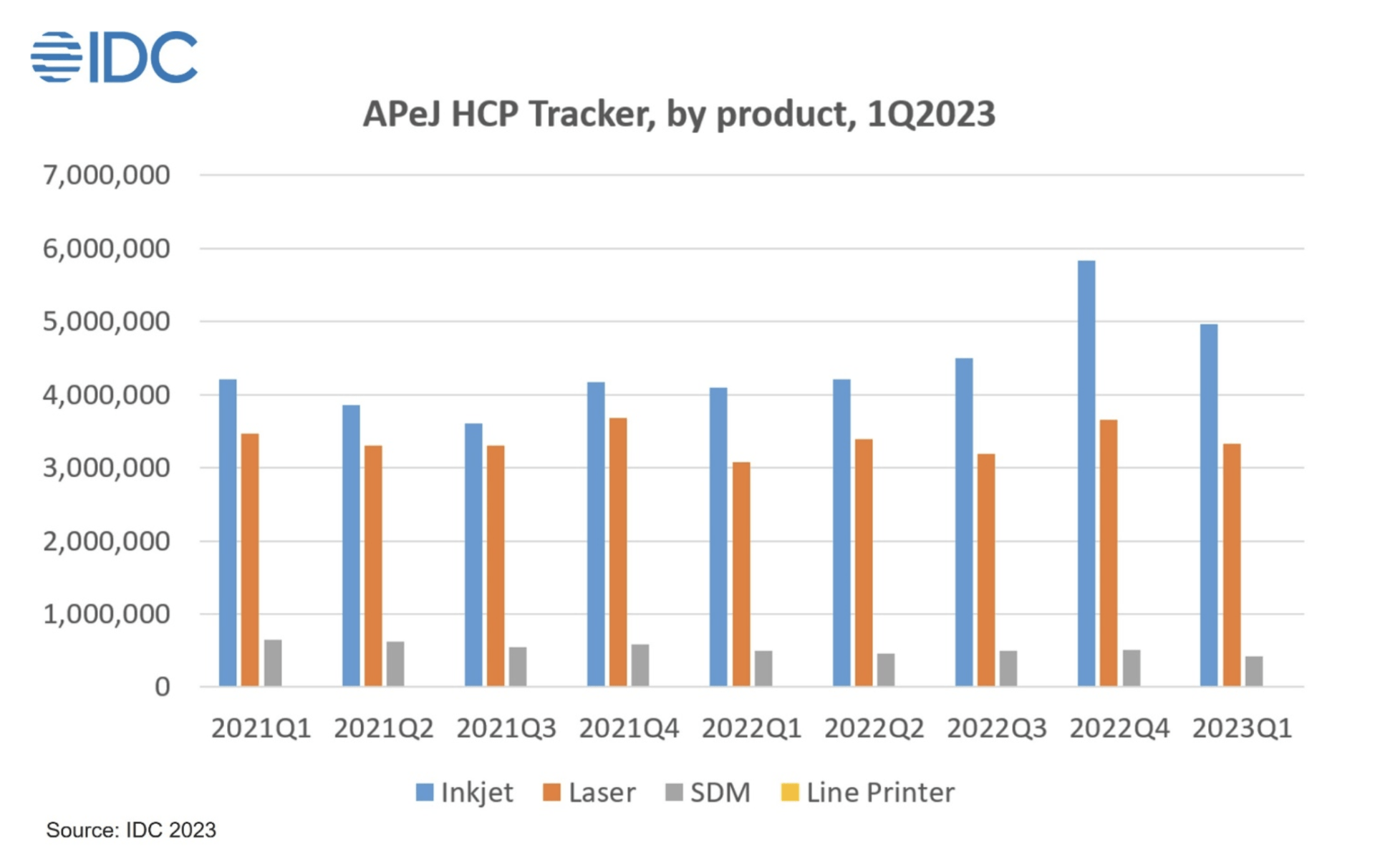

The Asia/Pacific excluding Japan (APeJ) Hardcopy Peripherals (HCP) market grew 13.8% year-on-year (YoY) but declined quarter on quarter (QoQ) in 1Q23.

According to the IDC Worldwide Quarterly Hardcopy Peripherals Tracker, the HCP market in Asia/Pacific registered 8.7 million units shipped in the first quarter of 2023, growing by 13.8% year-on-year (YoY).

IDC said that the growth can be attributed to increased demand for inkjet products because of the resumption in the demand from SOHO, small-medium businesses, and sustained consumer demand. Growth can also be attributed to the shift of the commercial segment away from laser printers and toward ink tank printers, which have been proven more cost-effective for printing.

The APeJ region’s overall inkjet market grew by 21.4% YoY. Countries such as New Zealand, the Philippines, and Taiwan reported yearly growth. Higher demand from home users, students, and SMB segments contributed to the YoY growth.

IDC added that the growth in China can be attributed to the alleviating of anti-epidemic policies, lower inkjet printer ASPs, and higher demand from SMBs and the government.

In the context of the laser printer market, the APeJ region registered yearly growth of 8.2%. Countries such as China, Korea, Thailand, Taiwan, Singapore, and the Philippines recorded growth. Increased demand for A3 copiers from enterprises, government, SMBs, and banking, financial services, and insurance (BFSI) segments is driving growth in these countries.

In the context of the laser printer market, the APeJ region registered yearly growth of 8.2%. Countries such as China, Korea, Thailand, Taiwan, Singapore, and the Philippines recorded growth. Increased demand for A3 copiers from enterprises, government, SMBs, and banking, financial services, and insurance (BFSI) segments is driving growth in these countries.

Also, in the context of the A4 laser printer market, countries such as Korea, China, Taiwan, Philippines, and Thailand had double-digit YoY growth due to increased demand from the commercial segments and government in 2023Q1 compared to 2022Q1.

“India, APeJ’s second largest printer market, showed a YoY decline in 2023Q1, owing to decreased demand for A4 printers from both commercial and consumer segments. In the short term, demand from the non-commercial segment is projected to remain low. Whereas commercial demand is likely to remain high, particularly for A3 printers. Other South Asian countries, such as Bangladesh and Sri Lanka, are likely to have low printer market growth in the near future due to inflation, power outages, and foreign currency reserve issues,” said Apoorv Kandharkar, Market Analyst at IDC Asia Pacific.

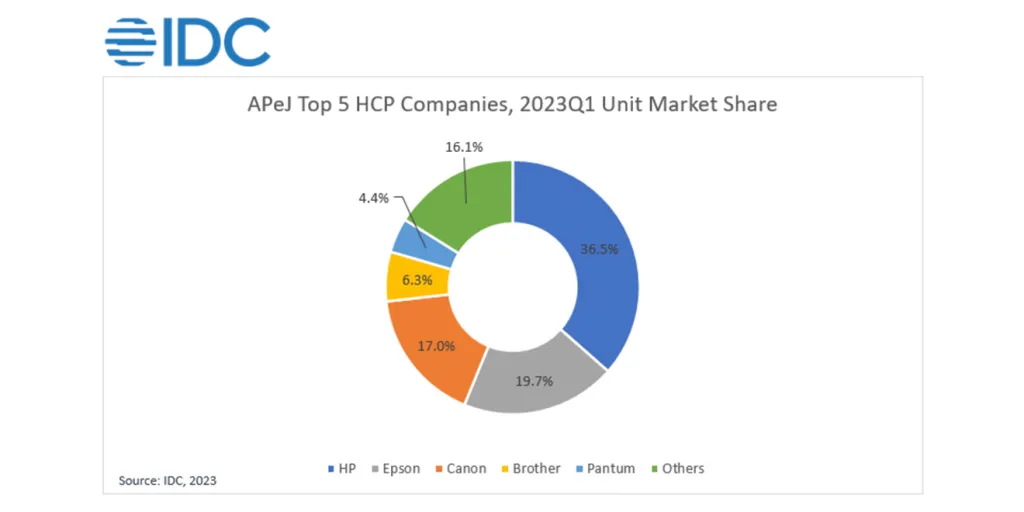

Top three home/office printer brand highlights:

HP has a solid stand as they continue the market leader position in 2023Q1 despite the slowdown in consumer demand across the region. End-user promotions are its key strategy. The countries with the highest YoY growth include China, Singapore, and the Philippines.

Epson overtook Canon and became second place at the beginning of 2023. It continues to have a strong B2B focus while making inroads in the commercial segment. The highest YoY growth occurred in the Philippines, China, and Thailand.

Canon dropped to third place in APeJ but still retained its second place in China. Facing a weakening demand, Canon increased its focus on ink tanks by increasing promotional activities across the region to gain a competitive edge amongst the brands in the market. Following China, the highest sequential and annual growth takes place in New Zealand.

“We are anticipating a slowdown in the market as the growth in 2023Q1 was mostly from pending shipment due to project postponement. The migration from ink cartridges to ink tanks will continue due to its cost-effectiveness, resulting in a continual decline in ink cartridges. On the other hand, laser products are expected to increase in the developing countries driven by the decentralized print environment trend while maturing countries are expected to decline from the device consolidation to high-speed devices,” said Paramat Arbhasil, Market Analyst at IDC Asia Pacific.

Categories : Around the Industry

Tags : APeJ HCP Market IDC Market Insights Shipments Tracker