Clover Imaging MBO spins out from 4L Holdings

November 22, 2019

The Clover Imaging Group’s management partners with Norwest Equity Partners and executes a management buyout (MBO) from 4L Holdings Group.

The Clover Imaging Group’s management partners with Norwest Equity Partners and executes a management buyout (MBO) from 4L Holdings Group.

Clover Imaging Group (CIG) announced today (21 November) that the CIG management and Norwest Equity Partners (NEP) have entered into a definitive agreement with 4L Holdings Group to acquire the Clover Imaging business unit. 4L Holdings’ lenders have approved the transaction.

In July The Recycler reported that following a preliminary earnings report that cut their current year earnings forecast as a consequence of competition from HP targeting US dealer channels with low priced OEM product in return for the dealer dropping reused products. Clovers “Silver Bullet” campaign was launched to reverse the impact of the HP strategy. The HP Xerox tie-up is expected to impact Clover as well as they are currently a significant supplier to Xerox of HP products. Clover Technologies (4L Holdings Group) has been in discussions to offload its imaging business.

As of September 2018, the 4L Holdings Group’s borrowing stood at $825 million (€701.3 million) with $65 million (€55.2 million) due for repayment or refinancing in May 2019 and $760 million (€646 million) due in June 2020.

They appointed legal advisors Kirkland & Ellis LLP and investment bank Jefferies LLC to assess the balance sheet alternatives and strategic options for the company following a preliminary earnings report that cut their current year earnings forecast.

Jim Cerkleski, Chairman of Clover Imaging Group said of the deal, “Clover’s executive leadership team, in partnership with NEP, will once again control the destiny of the company we built — demonstrating our unwavering commitment to the success of the business and our shared confidence in the aftermarket imaging supplies industry and consumers’ demand for environmentally conscious products like ours. Under our new, very low debt structure, we have a lot of flexibility moving forward and are well positioned to write the next chapter for Clover Imaging Group. We could not be more excited about the growth opportunities this new capital and partnership will provide.”

NEP is a middle-market investment firm focused on partnering with business owners to build companies into industry leaders. NEP has invested in more than 400 companies to date.

Tim DeVries, NEP Managing Partner, stated: “We are excited about our investment partnership with Clover Imaging Group — it is a well-run business with a highly experienced, nimble management team that knows how to innovate and execute. We look forward to collaborating with them to leverage the company’s strong position in the marketplace and put our capital and resources to work to further expand and grow the business.”

Once the transaction closes, which is expected to occur within the next month, Clover Imaging will operate as a separate and independent entity from 4L Holdings Group. Clover Imaging’s management team, including Jim Cerkleski, Chairman; George Milton, CEO; and Eric Martin, President; will continue to lead the business, which will remain headquartered in the Chicago area. Lincoln International acted as the exclusive investment banking representative for 4L Holdings and Clover Imaging Group, working closely with the company’s management team and shareholders throughout the sale process. Financial terms of the transaction were not disclosed.

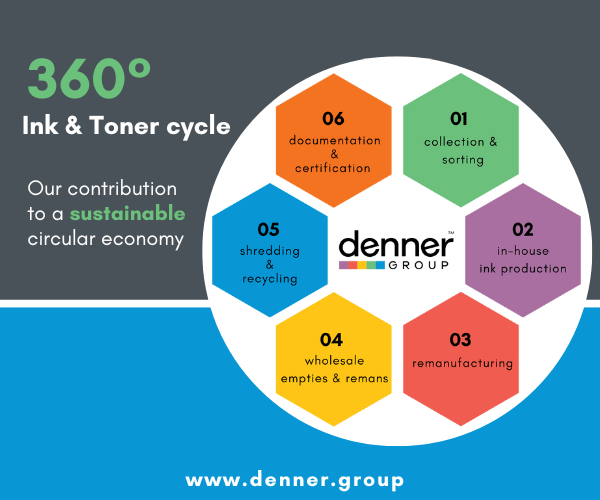

Providing the deal leaves enough working capital in the business it gives CIG, its employees, customers and suppliers a fresh start in a rapidly changing imaging market. The challenge is how does Clover get closer to the consumer to gain margin and value, remain competitive and sustain long supply lines moving empty cartridges around the world for remanufacturing and back to their North American and European markets.

While CIG has been caught up in exiting the 4L Holdings Group, the market continues to evolve and CIG’s crown as “the world’s largest collector and remanufacturer of printer cartridges” may be about to slip as Hubei Dinglong announces the closure of its deal to acquire Speed Infotech. Also producing higher volumes of remanufactured products is Ninestar and Aster.

Categories : World Focus

Tags : Aster Business Clover Hubei Dinglong M&A Ninestar Norwest Equity Partners Speed Infotech