HCP market in Malaysia records decline

March 29, 2023

Malaysia’s hardcopy peripherals market sees a year-over-year decline of 8.9% in 4Q22 despite surge in government purchasing, says IDC.

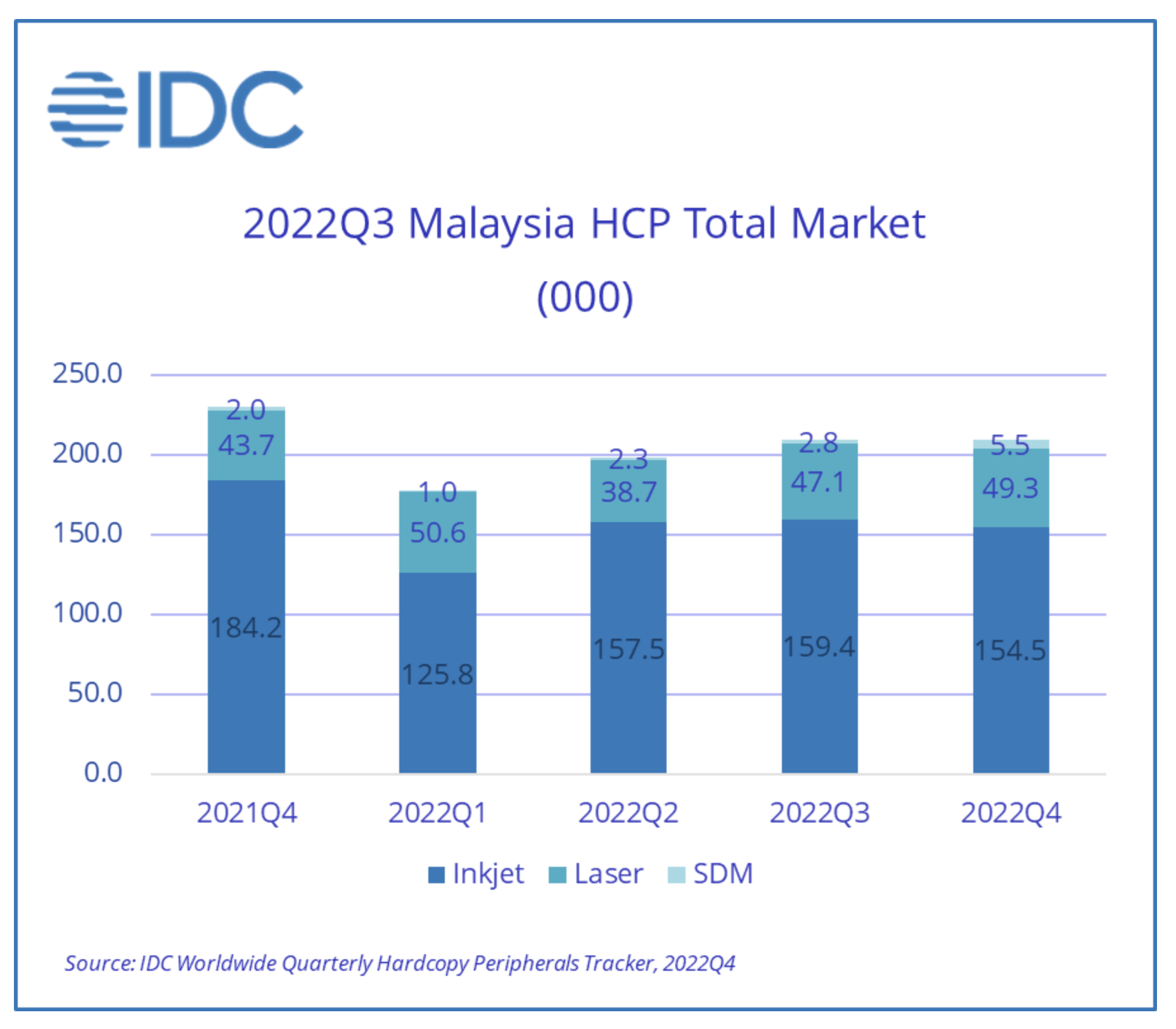

According to the International Data Corporation ’s (IDC) Worldwide Quarterly Hardcopy Peripherals Tracker, including inkjet, laser, and serial dot matrix (SDM), the overall 4Q22 market recorded a 8.9% year over year (YoY) decline and saw minimal change quarter-over-quarter (QoQ).

Commercial demand sees a slowdown, however, it remains robust following healthy domestic business activity. Government purchases in the A3 laser copier segment surged ahead of the Malaysian General Elections as ministries sought to utilize budgets ahead of the forming of a new administration. Vendors have begun sharply reducing shipments following a weak home-printer segment that has yet to recover.

Commercial demand sees a slowdown, however, it remains robust following healthy domestic business activity. Government purchases in the A3 laser copier segment surged ahead of the Malaysian General Elections as ministries sought to utilize budgets ahead of the forming of a new administration. Vendors have begun sharply reducing shipments following a weak home-printer segment that has yet to recover.

The overall market for 4Q22 was driven by the laser segment which grew by 4.6% QoQ and 12.9% YoY following a surge in public sector tenders for the A3 laser copier segment. The inkjet segment sees a 3.1% QoQ decline following the prior two quarters of growth, largely due to a recovery in the ink tank segment that made up for declines in the ink cartridge segment.

This follows severe stock constraints for ink tank models throughout the first three-quarters of 2022, whereas the ink cartridge segment continues to see significant contraction from last quarter as the market sees supply-side imbalance as household inkjet demand due to large procurements in 2020-2021 and the remote learning trend saw a rapid reversal as schools reopened for physical learning.

“Stable office demand for hardcopy peripherals even as the year comes to a close and strong public sector demand ahead of the Malaysian General Elections has been integral to supporting the market, however the outlook for the first half of 2023 is pessimistic as business activity will see a slowdown during the festive period and the tabling of a revised national budget for 2023 will pause public sector tender processes,” said Eugene Lim, Market Analyst at IDC Malaysia.

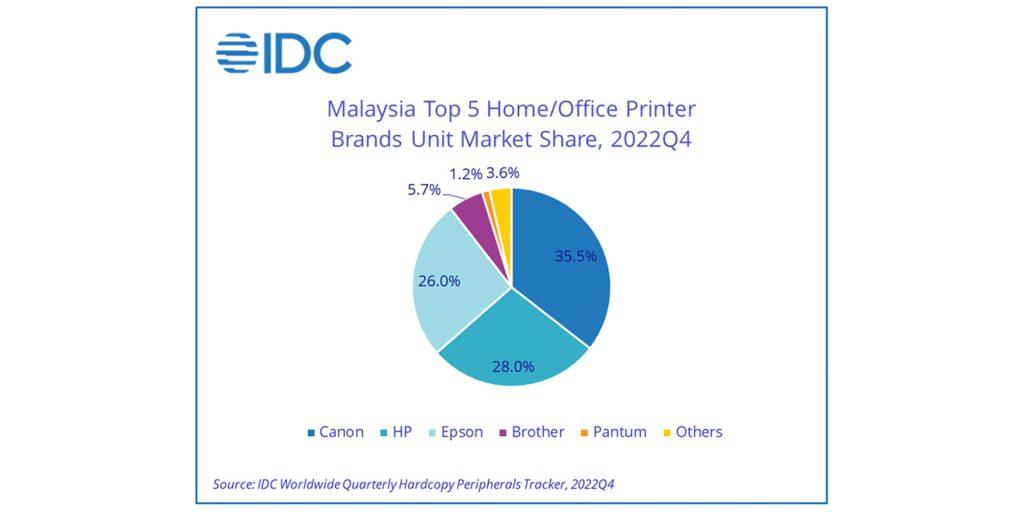

Top 3 home/office printer brands highlights:

Canon maintains its position as the market leader in the overall home/office printer market for 4Q22 holding a 35.5% share this quarter. The brand sees a YoY decline of 38.2% and 8.4% QoQ as its inkjet segment sees a sharp decline in shipments. The brand has been able to achieve a strong performance in its copier segment over the past two quarters through participation in government tenders.

HP remains the second market leader with a market share of 28.0%, experiencing a YoY growth of 1.3% however it faces a QoQ decline of 5.5% this quarter, as the brand similarly reduces inkjet shipments following a weak consumer market as the year-end approaches and consumer spending is focused on other aspects such as leisure.

Epson remains the third position market leader and has narrowed the lead between the second market leader position, with its 26.0% market share for 4Q22. The brand experiences a strong 64.7% YoY and a 24.4% QoQ growth following a similarly high performance from the previous quarter of 3Q22 supported by a surge in volume for their ink tank model line from strong corporate demand for ink tank models that has been present since 2Q22.

“Epson’s recovery in their ink tank model shipments have been the primary driver for the inkjet segment over the past two quarters, however as the segment is reaching over saturation and demand for the coming quarter of 1Q23 sees slowdown, the inkjet market will trend downwards for the foreseeable future,” added Lim.

Categories : World Focus

Tags : HCP Market IDC Malaysia Market Insight Report Shipments