European 3D print spend rising

July 12, 2018

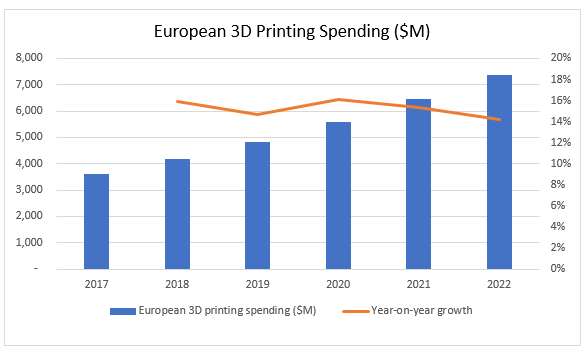

IDC has published its latest 3D printing spending guide, in which the total spend in Europe on printers, materials, software and services is forecast to total $3.6 billion (€3.08 billion) for 2017.

According to the latest update to the Worldwide Semiannual 3D Printing Spending Guide from International Data Corporation (IDC), the combined spending on 3D printing for Western Europe and Central and Eastern Europe will experience a five-year compound annual growth rate (CAGR) of 15.3 percent, with revenues reaching $7.4 billion (€6.34 billion) in 2022.

Western Europe delivered 83 percent of total European 3D printing revenues in 2017 and will remain by far the largest contributor in the wider European region, growing at a CAGR of 14.4 percent for 2017–2022. Central and Eastern Europe will be the fastest-growing region, however, with a CAGR of 19.1 percent for 2017–2022. According to IDC, the 3D printing market is evolving rapidly, with the European market continuing to show good momentum and 2018 proving to be a turning point.

“3D printing has the potential to expand the manufacturing industry, shift distribution locally, and implement on-demand production, reducing unnecessary inventories and shipping costs,” explained Julio Vial, Research Manager of European Imaging, Printing, and Document Solutions for IDC. “It will enable mass customization and printing of different products while reducing costs and recycling excess printer powder. Product weight can also be reduced, and fewer tools will be needed because 3D printers can replace some of them.”

Though 3D printing hardware generated the largest spending in 2017, the focus on materials will drive associated spending in the coming years, with a CAGR of 20 percent in the forecast period, exceeding the hardware component. Services will remain a key part of the market, as consulting and system integration services are a critical component of the 3D printing solution deployment.

Looking at the verticals, discrete manufacturing accounted for more than half of total spending on 3D printing in the wider region in 2017, and will continue to be the largest investor by industry, with a CAGR of 14.5 percent for 2017–2022. Within discrete manufacturing, the automotive and aerospace subindustries are the biggest contributors (and also the most mature subindustries), while the medical sector is expected to develop further in the next few years, with a projected 19.5 percent CAGR in the forecast period.

Other verticals, such as healthcare and professional services, are already using 3D printing, with spending at over 10 percent of the total market. Healthcare providers in particular are expected to grow their spending in 3D printing, with a CAGR of 20.9 percent from 2017 to 2022, as these organizations will adopt internally and develop direct skills and capabilities around 3D printing.

Western Europe is driving spending in the wider region: as shown in the latest European Vertical Market Survey, more than 17 percent of respondent organizations are adopting or planning to adopt 3D printing in 2018.

“In Western Europe, discrete manufacturing is clearly the largest industry regarding spending on 3D printing solutions, but healthcare and professional services are continuing to experiment and are embracing the technology as new use cases and materials come to market,” said Gabriele Roberti, research manager, Customer Insights and Analysis, IDC.

In Central and Eastern Europe 3D printing is gaining in popularity too. The technology is starting to transform many industries in the region — the portfolio of 3D printing use cases is already vast, is evolving quickly, and differs from industry to industry.

“There is a growing number of start-ups, many of them using EU funding, specializing in 3D printing services. EU funds are the main driver for this technology in Central and Eastern Europe,” said Evelin Stoev, senior analyst at IDC. However, many traditional manufacturing companies, being locked in the old ways of doing things, do not have time to experiment with new technologies like 3D printing, nor to research emerging use cases in the market — and this is the major inhibitor to faster penetration of this technology in the region. This means that major gaps in 3D printing experience relative to Western Europe and especially the U.S. and Japan will be hard to close in the near future.

Categories : Around the Industry

Tags : 3D printing Europe IDC