ANZ organisations spend more on software

November 25, 2021

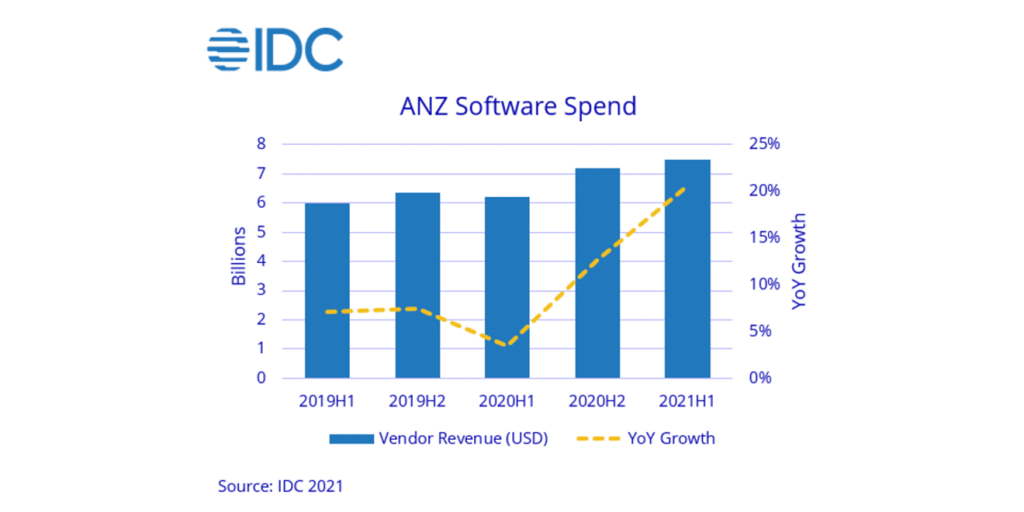

With COVID-19 significantly increasing the pace of innovation, the beginning of 2021 had witnessed a strong rebound in software spending across ANZ.

More organisations are embarking on their digitisation journeys and leveraging digital technologies. This is not only to remain afloat, but also to champion customer, employee and partner journey and support.

According to IDC’s Worldwide semi-annual Software Tracker, 1H2021, the total ANZ software market reached $7.5 billion (€6.7 billion), showing a double-digit annual growth in both countries. It grew by 20.6% year-over-year (YoY) in Australia and 20.4% – in New Zealand, during the first half of 2021.

According to the IDC survey, ANZ organisations continue to invest in cloud services to increase competitiveness, efficiency, business resiliency and support innovation. In 1H2021, cloud adoption showed a strong annual increase of 31%, where cloud revenues now represent 45% of the total ANZ software market.

ANZ organisations promptly responded to a changing “working from home/anywhere” environment, caused by COVID-19 restrictions. They demonstrated great agility, while gradually adjusting to a new normal. Not surprisingly, the collaborative applications market witnessed the strongest annual growth (49%) and reached $257.8 million (€229.7 million) across ANZ software market. Businesses keep heavily investing in Conferencing and Team Collaborative applications to support productivity, effective communications with clients and partners, and also very importantly – to promote engagement and a sense of belonging among employees in a new hybrid environment.

Artificial Intelligence Platforms have shown the second strongest YoY increase, growing by 35% across ANZ, reaching $111.5 million (€99.4 million). This rapid growth indicates strong demands from ANZ organisations in modernisation and streamlining of core business processes. Implementation of AI Software services and Intelligent Knowledge discovery tools is on the rise to support decision-making, forecasting, and to improve business outcomes. “In an increasingly digital-first world, an abundance of customer and business data fuels wider adoption of AI platforms,” said Anastasia Antonova, Senior Market Analyst as IDC Australia/New Zealand, “to stay on top of the game and meet individual customer needs, organisations across ANZ invest in intelligent process automation tools and leverage AI capabilities to revamp operational processes, improve customer and business data analysis, support decision-making and forecasting, and, as a result, ensuring flourishing customer experience”, Antonova continued.

The Integration and Orchestration Middleware software market recorded a third strongest annual growth of 31% across Australia and New Zealand, reaching $164.6 million (€146.6) in 1H2021. As the world had witnessed over the last two years, COVID-19 has massively accelerated digital and innovative initiatives, leading millions of businesses to explore and adjust to a new reality, where digital comes first. Such strong growth of integration software has been largely driven by legacy modernisation, hybrid integration, workflow/process automation and API-led innovation initiatives. As business requirements are rapidly changing, demanding more interconnectivity and innovation with less maintenance, IDC expects demands for integration and API management software to continue their strong growth trajectory in the second half of 2021 and further.

IDC foresees an increased adoption of cloud and digital technologies beyond 2021 across ANZ, as organisations will continue to reinvent their current business processes to enable future growth, increased resiliency, agility and competitiveness in the digital-first era.

Categories : Around the Industry

Tags : IDC Market Research Sales Software