Mixed results for Q1 hardware sales

May 20, 2019

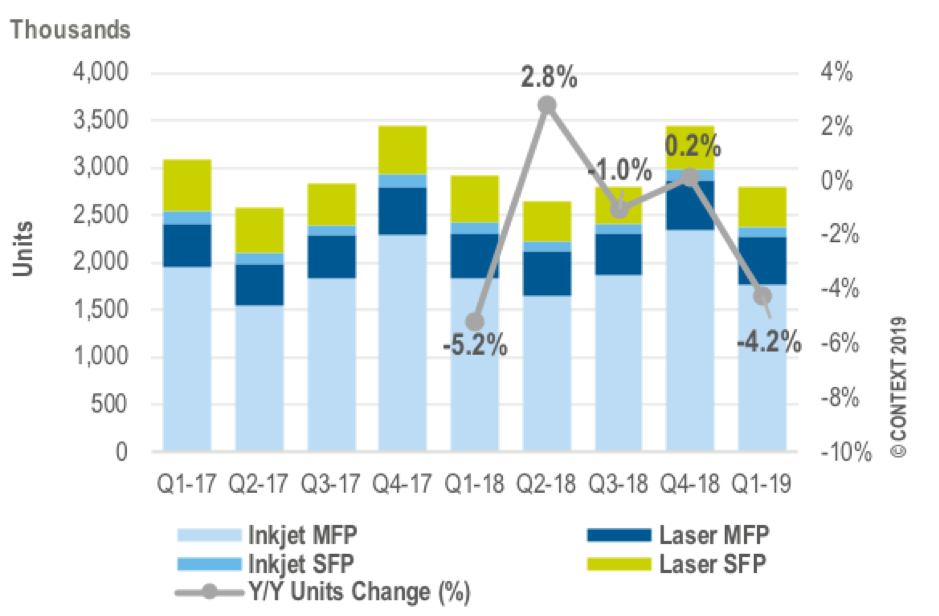

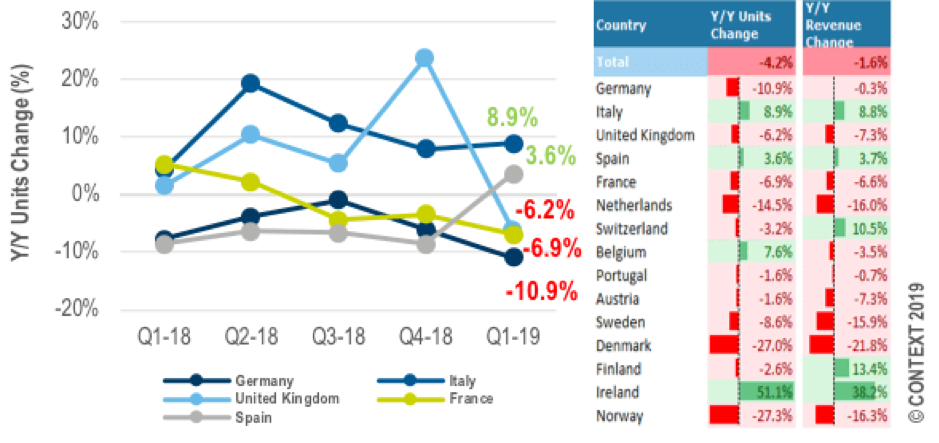

Graph – Y:Y change in imaging units sold through distributors – Top 5 WE countries Table – Y:Y change in imaging units sold and revenue – WE distribution, Q1 2019

CONTEXT reports printer hardware distributor sales are down sharply in the Western Europe market.

According to CONTEXT, printer markets have become increasingly healthy over the recent years and are currently robust, although, as always, they remain competitive. However, sales of printer hardware through distributors in West Europe (WE) were sharply down by 4.2 percent year-on-year in Q1 2019, according to the latest distribution data published by CONTEXT.

This is not a surprise: the first quarter is, historically, the weakest of the year – and it is usually followed by a weak second quarter, the company adds.

Sales of multifunction printers (MFPs) were down by 1.7 percent year-on-year: even though laser MFPs saw a sharp growth of 4.6 percent, this was offset by the negative performance (- 3.4 percent) of inkjet MFPs which account for almost 78 percent of sales in WE, according to CONTEXT.

Sales of single-function printers (SFPs) registered a strong decline 13.6 percent and contributed to the overall negative performance in Q1 2019. The ongoing shift from single- to multifunction devices is likely to be further consolidated with distributors reporting that reseller demand for SFPs, particularly lower-spec models, is low.

Laser MFPs saw growth of 4.6 percent in Q1 2019, driven by the exceptional performance of consumer-targeted devices (sales up by 80 percent), especially monochrome printers (sales up by 113.1 percent), which is primarily due to falling ASPs as distributors use promotions and discounts to clear stock and get ready for the arrival of new models.

Consumer printers as a whole steadily increased their market share and drove overall imaging growth in Q1 2019, as they had done in 2018. Sales of business-targeted models, which account for 83 percent of laser MFP sales and 92.8 percent of revenue, dropped by 13.4 percent (leading to a fall in revenue of 5.5 percent), mainly because the ASP is continuing to increase. According to CONTEXT, this suggests companies (small and medium businesses) are replacing entry-level business-targeted models with mid- and high-level consumer- targeted devices.

Inkjet MFPs reversed the positive trend seen in 2018 with volume sales declining by -3.4 percent in Q1 2019. However, revenues were up by 2.3 percent, helped by increased sales in mid- and high-price ranges and driven by sales of monochrome and A3 devices, which saw revenue growth of 60 percent and 20.7 percent on the previous year.

Context added that it is interesting to note the exceptional growth of A3 printer sales in the consumer segment, by 145.4 percent – another factor suggesting that SMBs are buying consumer inkjet devices with greater functionality to fulfil their commercial needs.

Imaging sales and revenues declined in almost all WE countries in Q1 2019. Italy was the only top five WE country which continued to register a positive year-on-year performance in terms of both units and revenues. The increase there was driven by strong consumer sales from HP (sales up by 62 percent), Brother (up 38 percent), Samsung (up 15.6 percent) and Ricoh (up 15.5 percent), which share 69.9 percent of the country’s printer market.

Spain also saw growth of both units and revenues in Q1 2019, reversing the negative trend of 2018.This positive performance was driven by mid-range and high-range consumer devices, and by brands such as Kyocera (sales up by 149.3 percent) and Epson (up 11 percent), even though these have a combined market share of only just over 22 percent.

In the United Kingdom, where consumer confidence is low amidst Brexit-related uncertainty, last year’s positive trend was reversed and sales (units and revenues) declined in Q1 2019. There were falls in both consumer and business segments, and significant drops for brands such as Ricoh (year-on-year sales down by 90.5 percent), OKI (down 36.8 percent), Epson (down 34.3 percent), Lexmark (down 9.9 percent), Canon (down 9.1 percent), Xerox (down 4.9 percent) and Brother (down 3.5 percent), although other companies, which share 59.4 percent of the country’s printer market, saw smaller declines.

Germany and France continued to register negative year-on-year changes in volume sales and revenues, with strong falls in both consumer and business segments. This had an effect on all the brands which share over 94 percent of the printer market in these countries: Ricoh saw volume sales decrease by 39.8 percent, as did Samsung (down 33 percent), OKI (down 31.4 percent), Kyocera (down 16.7 percent), Epson (down 15.4 percent), HP (down 12.7 percent), Lexmark (down 8 percent), Brother (down 5.8 percent) and Canon (down 3.7 percent).

Looking ahead, the market is likely to see other changes alongside the ongoing shift from single-function to multifunction printers, according to CONTEXT.

Managed print services (MPSs) that allow customers to transform their workplaces from paper to digital will continue to expand in 2019 as distributors and retailers use their partnerships with vendors to provide comprehensive, cloud-based MPS solutions to consolidate workplace printing.

The emergence of enterprise Internet of Things (IoT) platforms offering asset management, fault detection, smart analytics and remote monitoring presents a broader opportunity for MPS providers to participate.

Over the next one or two years, CONTEXT expects to see relatively fast growth in sales of production-standard inkjets, wide-format printers (both digital and inkjet), and digital toner-based devices. However, the five-specific print-market segments that are likely grow at a relatively higher rate are packaging and specialty packaging, labels and wrappers, signage, direct mail and point-of-purchase.

Categories : World Focus

Tags : Context Market Research Printer hardware Western Europe