Indian HCP market also in decline

May 24, 2019

Amidst slowdown in demand, the Indian Hardcopy Peripherals (HCP) market posts 4.1 percent year-on-year decline in Q1 of 2019, IDC India reports.

Amidst slowdown in demand, the Indian Hardcopy Peripherals (HCP) market posts 4.1 percent year-on-year decline in Q1 of 2019, IDC India reports.

The Indian HCP market posted quarterly shipments of 0.85 million units in the first quarter of 2019, with a decline of 4.1 percent on a year-on-year basis, as per the latest IDC’s Asia/Pacific Quarterly Hardcopy Peripherals Tracker, CY2019Q1.

IDC says the decline was primarily because of the slowdown in both consumer and commercial demand.

Despite a slowdown in demand, inkjet printer shipments grew year-on-year by 5.6 percent led primarily by Epson. The growth was led by ink tank printers which recorded year-on-year growth of 21.2 percent, the highest growth in the last five quarters.

While the overall laser printer market declined year-on-year by 11.9 percent, the copier segment grew by 19.4 percent year-on-year and recorded the highest shipment ever. The copier market grew on the back of strong demand from government and government’s continued tight monitoring of the refurbished copier market.

This comes after the recent reported decline of Worldwide shipments and the Western Europe HCP market declines.

“Weak consumer demand, observed in 2018Q4, continued well up to the middle of 2019Q1 as well and this largely affected the overall Inkjet market’s health. Demand from SMBs and SOHOs was also on the lower side due to the credit issues they continue to face with banks affecting demand for laser printers. Despite the scheduled government elections, the consumption from the Government remained steady, owing to it being the last quarter of the financial year. After the election dates were announced on March 10, 2019, with the Model Code of Conduct coming into effect, government demand decreased as multiple Government deals were put on hold,” says Bani Johri, Market Analyst, IPDS, IDC India.

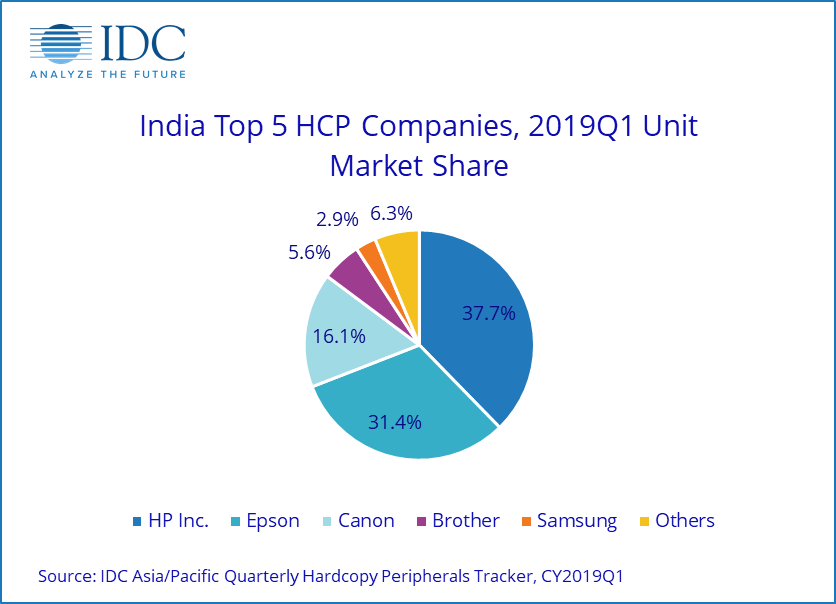

According to IDC India, HP Inc. (excluding Samsung) maintained its leadership in the HCP market with a share of 37.7 percent while its shipment declined by 7.6 percent year-on-year. The decline was primarily led by the inkjet segment, which declined by 11.6 percent year-on-year, due to muted demand from the consumer market even though multiple end-user and channel schemes were active.

In the inkjet segment, HP retained its 2nd position with a share of 24.6 percent. On the copier side, HP shipments grew by 15.7 percent quarter over quarter due to strong demand from the corporate and Government segment. In the laser segment (excluding copiers) HP maintained its leadership position, capturing more than 60 percent of the market share.

Epson remained at 2nd position in the overall HCP market by clocking 13.1 percent year-on-year growth and capturing 31.4 percent of the unit market share. It also continued to hold its leadership position in the inkjet segment while increasing its unit market share to 56.1 percent, thus increasing by 11.6 percentage points.

IDC says, the growth came primarily on the back of its new models, especially L3110 and L3150, along with multiple lucrative distributor schemes. Epson’s gains were mainly due to SMBs are preferring ink tank over expensive laser printers as it remains the preferred choice in commercial segment when it comes to ink tank printers.

Canon recorded year-on-year decline of 10.5 percent while maintaining its 3rd position in the HCP market and capturing 16.1 percent unit market share. The decline in Canon’s shipment was largely due to inventory correction exercise undertaken due to the excessive stockpile in previous quarters.

In the copier segment, it continued to lead the market with 24.0 percent unit market share. The Government’s stricter regulations on the refurbished market coupled with increased demand from Government helped Canon in maintaining its dominance in the copier market.

“Post 2019Q1, market conditions are expected to slightly improve due to summer holidays followed by back-to-school programs leading to improvement in consumer demand. Ink tank printers will continue to gain traction and partially make up for the decline in laser printer shipments as well as ink cartridge printers. Post elections, government demand is also expected to return to normal giving boost to laser copier market,” says Nishant Bansal, Research Manager, PCD & IPDS, IDC India.

Categories : Around the Industry

Tags : HCP IDC India Market Research